You didn’t inherit a trust fund. Your parents couldn’t afford to pay for college, let alone hand you a down payment for a house. And every time you see another “self-made” entrepreneur reveal their parents gave them $200,000 to start their business, you feel that familiar knot in your stomach.

Here’s the truth nobody wants to say out loud: most wealth-building advice assumes you’re starting from middle class. It assumes you have emergency savings, no bad debt, and a safety net. If that’s not you, those strategies feel like reading a recipe that starts with “first, inherit a kitchen.”

But building wealth from scratch—true zero-to-something wealth—is absolutely possible. It just requires a different playbook. One that accounts for where you’re actually starting, not where personal finance gurus wish you were starting. This guide breaks down exactly how to build wealth from scratch using strategies that work when you’re beginning with nothing but determination and discipline.

Understanding What Building Wealth From Scratch Actually Means

Let’s define terms before we go further.

Building wealth from scratch means accumulating assets and financial security when you start with minimal or zero capital, no financial support from family, and often significant obstacles like debt or low income. It’s not about becoming a billionaire in five years. It’s about systematically moving from financial vulnerability to financial stability, then from stability to genuine wealth accumulation.

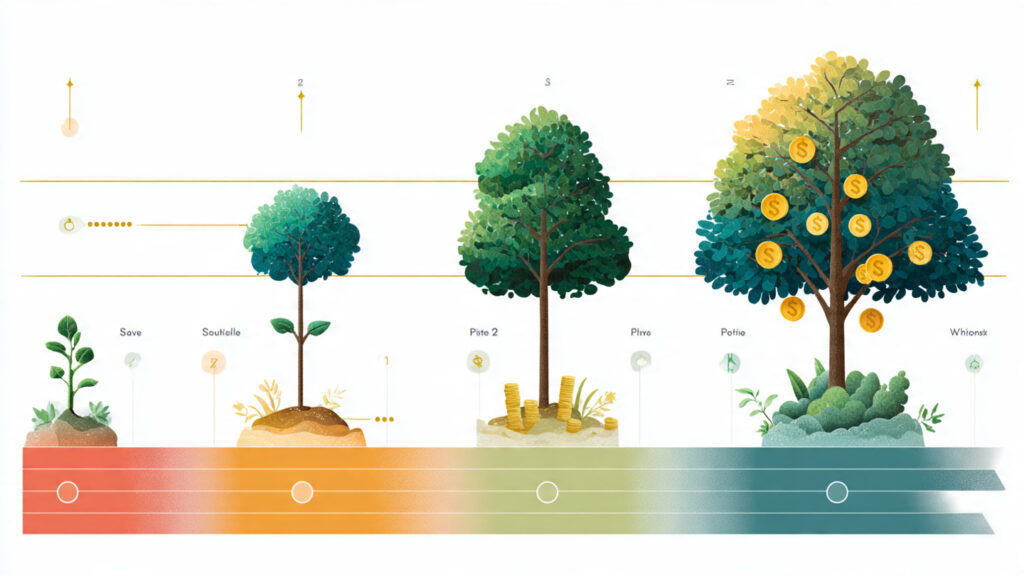

The wealth-building journey has three distinct phases:

Phase 1: Financial Survival (Negative to zero net worth)

You’re covering basic needs, eliminating toxic debt, and building a small emergency buffer. This phase is about stopping the bleeding.

Phase 2: Financial Stability ($0 to $100,000 net worth)

You’re debt-free or managing good debt, building emergency savings, and starting to invest consistently. This is where the foundation gets built.

Phase 3: Wealth Accumulation ($100,000+ net worth)

Your money starts working harder than you do. Compound growth accelerates. You’re optimizing taxes, diversifying income, and building true financial independence.

Most people who build wealth from scratch spend 3-7 years in Phase 1, another 5-10 years in Phase 2, and then watch Phase 3 accelerate faster than they imagined. The key is accepting which phase you’re in and using the right strategies for that phase.

Step 1: Shift Your Relationship With Money Immediately

You can’t build wealth from scratch with a scarcity mindset, but you also can’t build it with toxic positivity about abundance. You need something different: strategic optimism grounded in math.

Here’s what that looks like in practice.

Acknowledge your current financial reality without shame. Write down your exact numbers: income, expenses, debts, assets. Most people avoiding this step stay stuck for years. Wealthy people look at numbers constantly. Poor people avoid them. It’s that simple.

Separate your identity from your bank account. Your current net worth is a data point, not a character judgment. Someone who started with nothing and built $50,000 in net worth demonstrated more financial skill than someone who inherited $500,000 and still has $500,000.

Study wealthy people who started from scratch. Not celebrities actual wealthy people in your community. The business owner who started as a broke immigrant. The investor who was bankrupt at 30 and financially free at 45. These stories teach you that wealth-building from scratch follows patterns, not luck.

The biggest mental shift? Understanding that wealth is built through cumulative small wins, not lottery-ticket thinking. People fantasize about the big break while ignoring the boring consistency that actually builds wealth.

Step 2: Master the Wealth-Building Income Formula

You can’t build wealth from scratch on minimum wage working 40 hours per week. That’s not pessimism that’s math. But you can build wealth by engineering your income strategically.

The formula is simple: Increase earning power + Decrease lifestyle inflation = Wealth acceleration

Here’s how to increase earning power when you’re starting from scratch:

Skill stacking beats single skills. Don’t just learn marketing learn marketing + basic data analysis + email copywriting. The combination makes you exponentially more valuable than each skill alone. Companies pay premium rates for people who bridge multiple disciplines.

Focus on high-demand, trainable skills first. Software development, digital marketing, sales, project management, and data analysis all have massive demand and can be learned without expensive degrees. Trade skills like electrical work, plumbing, and HVAC offer excellent income and are chronically understaffed.

Negotiate relentlessly. Research from Harvard shows that 57% of men negotiate their first job offer, but only 7% of women do. The people who negotiate their salary just once earn over $500,000 more across their lifetime. If you’re building wealth from scratch, you cannot leave this money on the table.

Build side income strategically. Not random gig work strategic side income that builds assets or skills. Freelancing in your field builds your portfolio and reputation. Creating digital products builds passive income potential. Random DoorDash hours just trade your time for money without building anything.

Here’s a framework I’ve seen work repeatedly: Year 1-2, focus entirely on increasing your primary income by 30-50% through skills and negotiation. Year 3-5, add strategic side income that compounds. Year 6+, convert side income into semi-passive or fully passive income streams.

When evaluating any income opportunity, ask: “Does this just trade my time for money, or does it build an asset, skill, or relationship that compounds?”

Step 3: Build Your Financial Foundation With Precision

Most personal finance advice tells you to save six months of expenses immediately. If you’re living paycheck to paycheck, that’s like telling someone to climb Everest before they’ve hiked a local trail.

Here’s the actual sequence that works when you build wealth from scratch:

Milestone 1: Save $500 as fast as humanly possible. This tiny buffer prevents most financial emergencies from spiraling into debt. Medical copay, car repair, broken phone $500 covers the majority of small emergencies that derail people. Getting this $500 is your first and most important goal.

Milestone 2: Kill high-interest debt with focused aggression. Anything above 8% interest is bleeding you dry. Credit cards, payday loans, some personal loans these must die. Use the avalanche method (highest interest first) for math optimization or the snowball method (smallest balance first) for psychological wins. Both work. Debating which is perfect while staying in debt doesn’t work.

Milestone 3: Build to one month of bare-bones expenses. Not your current expenses your absolute minimum survival expenses. If you lost your income tomorrow, what’s the minimum you need to keep a roof over your head and food on the table? Save that amount.

Milestone 4: Increase to three months, then six months. Now you’re building real security. This takes time, but every dollar in this fund is buying you freedom from desperation decisions.

If you’re trying to figure out exactly how much you need at each stage, a good compound interest calculator can show you how your emergency fund can grow over time in a high-yield savings account instead of sitting in checking earning nothing.

The mistake most people make? Building emergency savings while carrying credit card debt. If you’re paying 22% interest on credit cards while earning 1% on savings, you’re losing 21% on every dollar. Get that toxic debt gone first.

Step 4: Start Investing Earlier Than You Think You’re Ready

Here’s an uncomfortable truth: every month you delay investing costs you exponentially more than you think.

Someone who invests $200/month starting at age 25 will have more money at retirement than someone who invests $400/month starting at age 35, assuming identical returns. That’s not motivation-poster nonsense that’s compound interest math.

When you’re building wealth from scratch, you might think “I’ll invest once I have more money.” That’s exactly backwards. You invest to create more money.

Start with whatever you have, even if it’s $25/month. The habit matters more than the amount initially. A person investing $25/month who increases it by 10% each year will build significant wealth over decades.

For beginners building wealth from scratch, low-cost index funds are your best friend. Specifically, total market index funds or S&P 500 index funds with expense ratios under 0.10%. Vanguard, Fidelity, and Schwab all offer excellent options.

The three-fund portfolio is the gold standard for simplicity:

- U.S. total stock market index (60-70%)

- International total stock market index (20-30%)

- U.S. total bond market index (10-20%, adjusted for age)

Rebalance once per year. That’s it. This boring strategy beats 80% of actively managed funds over 20-year periods.

Maximize tax-advantaged accounts religiously. If your employer offers 401(k) matching, contribute at least enough to get the full match that’s an instant 50-100% return. Then prioritize Roth IRA contributions (currently $7,000/year limit for those under 50). These grow completely tax-free.

The order of operations: 401(k) to employer match → Roth IRA to maximum → 401(k) to maximum → taxable brokerage account.

Ignore market timing. You can’t predict it. Professionals can’t predict it. Dollar-cost averaging (investing the same amount regularly regardless of market conditions) eliminates emotion and historically produces excellent returns.

Step 5: Increase Your Income Ceiling Systematically

Here’s where building wealth from scratch diverges from traditional middle-class wealth advice. You need to become aggressive about income growth.

Wealthy people obsess over increasing income. Middle-class people obsess over cutting expenses. When you’re building from scratch, you need both, but income growth creates exponential possibilities that cutting lattes never will.

Career income acceleration strategies:

Document your wins obsessively. Keep a “brag folder” with every accomplishment, positive feedback, successful project, and money saved or earned for your company. When you negotiate salary or interview elsewhere, this is your ammunition.

Job hop strategically every 2-3 years in your first decade. Employees who stay at companies longer than two years earn 50% less over their lifetime compared to those who move strategically. Loyalty doesn’t build wealth from scratch strategic moves do.

Become undeniable in one specific area. Don’t try to be decent at everything. Become the absolute best at one valuable thing. The person who’s “pretty good” at five things earns average wages. The person who’s exceptional at one thing and competent at two others earns exceptional wages.

Business and side income acceleration:

Solve expensive problems for people with money. Broke people want cheap solutions. Wealthy people and businesses pay premium prices for excellent solutions to expensive problems. Position yourself accordingly.

Build assets, not just income. A freelance client pays you once. A digital course pays you repeatedly. A software tool pays you while you sleep. Always ask: “How do I convert this one-time income into a repeating asset?”

The 1,000 True Fans principle applies universally. You don’t need millions of customers. If you can find 1,000 people willing to pay you $100/year for something valuable, that’s $100,000 in annual revenue. Niche expertise beats broad mediocrity.

Step 6: Protect Your Wealth From Stupid Mistakes

Building wealth from scratch is hard. Losing it to preventable mistakes is tragic.

Insurance isn’t optional when you have nothing. It’s mandatory. One medical emergency, car accident, or lawsuit can erase years of progress. Get health insurance (marketplace plans if you don’t have employer coverage), adequate auto insurance, and renter’s or homeowner’s insurance at minimum. As your net worth grows past $100,000, add umbrella liability insurance.

Avoid these wealth-destroying decisions:

Buying new cars. A $35,000 new car loses $10,000+ in value the moment you drive it off the lot. A $15,000 three-year-old used car with 30,000 miles gives you 90% of the utility at 43% of the cost. When you’re building wealth from scratch, new cars are financial suicide.

House-poor syndrome. Banks will approve you for a mortgage that consumes 40%+ of your income. That doesn’t mean you should take it. Housing costs above 30% of gross income make wealth-building nearly impossible. Rent cheaply or buy modestly until your income rises significantly.

Mixing finances with romantic partners too quickly. Money problems are the leading cause of divorce. Don’t combine finances, co-sign loans, or buy property together until you’re married or have iron-clad legal agreements. Your wealth-building journey shouldn’t be destroyed by someone else’s financial chaos.

Lifestyle inflation. This is the silent killer. You get a raise, immediately increase your spending, and never actually build wealth. The formula that works: every time your income increases, save or invest at least 50% of the increase before adjusting lifestyle.

If you’re considering a major purchase like a house or wondering whether you can afford to increase your lifestyle, use a mortgage calculator to see the real long-term cost, not just the monthly payment. Wealthy people calculate total cost of ownership. Broke people only look at monthly payments.

Step 7: Build Multiple Income Streams Strategically

The wealthy have an average of seven income streams. When you’re building wealth from scratch, you won’t get there overnight, but you should have a roadmap.

Income stream progression that works:

Year 1-3: Primary job income + high-yield savings interest

Focus on mastering your career and building emergency funds earning actual interest (currently 4-5% in high-yield savings accounts, not 0.01% in traditional banks).

Year 4-6: Primary job + investment income + one strategic side income

Your investments start producing small but real returns. You’ve built one legitimate side income source that’s optimized and semi-passive.

Year 7-10: Primary job + investment income + 2-3 income streams + potential rental income

You’ve diversified intelligently. Maybe you have dividend stocks, a rental property, a digital product, and consulting income. You’re no longer completely dependent on job income.

Year 11+: Multiple passive and semi-passive income sources

You’ve reached the point where you could survive (even if not comfortably) without your primary job. True financial independence is on the horizon.

The critical principle: Each new income stream should require less of your active time than the previous one. You’re moving from active income (trading time for money) toward passive and semi-passive income (money working while you sleep).

Don’t build seven income streams that all require 20 hours per week. Build income streams that scale or run with minimal involvement once established.

Common Wealth-Building Mistakes to Avoid

After watching hundreds of people try to build wealth from scratch, certain mistakes appear repeatedly:

Trying to get rich quick instead of building wealth steadily. Crypto gambling, day trading, MLMs, options trading these aren’t wealth-building strategies. They’re lottery tickets. Some people win. Most lose. Wealth-building from scratch requires boring consistency, not exciting gambles.

Underpaying yourself to invest. Yes, investing is crucial. But if you’re so broke that you’re constantly tapping emergency funds or going into debt, you’re not investing you’re gambling. Build a sustainable budget first.

Comparison paralysis. Someone on social media is always doing better than you. Ignore them. Your only competition is your previous self. Are you better financially than you were 12 months ago? That’s what matters.

Waiting for perfect conditions. Perfect timing doesn’t exist. Starting small and imperfectly beats waiting for perfect conditions that never arrive.

Neglecting learning. The best investment you can make when building wealth from scratch is in skills that increase your earning power. Books, courses, certifications that lead to higher income pay for themselves immediately.

Taking Action: Your 90-Day Wealth-Building From Scratch Roadmap

Here’s exactly what to do in the next 90 days:

Days 1-7:

- Calculate your exact net worth (assets minus liabilities)

- Track every dollar you spend for one week

- Open a high-yield savings account if you don’t have one

- List your top three skills and research what people with those skills earn

Days 8-30:

- Build your first $500 emergency fund

- Create a realistic budget using the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt)

- Research one skill you could learn in 6-12 months that would increase your income by 20%+

- If you have high-interest debt, create an aggressive payoff plan

Days 31-60:

- Open an investment account (Roth IRA if possible)

- Make your first investment, even if it’s just $25

- Start your skill development with free or low-cost resources

- Negotiate one thing: your salary, a bill, a rate, anything

Days 61-90:

- Build emergency fund to one month of bare-bones expenses

- Set up automatic investing, even if it’s small amounts

- Complete the first milestone in your skill development

- Create a side income plan based on your skills

The goal isn’t perfection. It’s momentum. Every small step compounds when you’re consistent.

The Long Game: What Building Wealth From Scratch Really Looks Like

Let’s be honest about timelines because false expectations kill motivation.

If you’re starting from absolute zero, building your first $10,000 in net worth typically takes 1-3 years of focused effort. That feels slow. It’s supposed to feel slow. You’re building financial muscles you never had.

Getting from $10,000 to $100,000 takes another 4-7 years for most people building wealth from scratch. But here’s the magic: getting from $100,000 to $200,000 takes only 3-5 years. From $200,000 to $500,000 takes another 4-6 years.

The progression accelerates because compound growth is exponential, not linear. Your first $10,000 earns maybe $800/year in investment returns at 8%. Your $100,000 earns $8,000/year. Your $500,000 earns $40,000/year. Eventually, your money works harder than you do.

Charlie Munger, who built billions starting from a middle-class background, said: “The first $100,000 is a bitch, but you gotta do it.” He was right. That first $100,000 is the hardest mountain to climb when you build wealth from scratch. After that, compound interest becomes your unfair advantage.

Final Thoughts: You’re Playing a Different Game

Building wealth from scratch means you’re playing on hard mode. You don’t have generational wealth, family safety nets, or the financial literacy that comes from growing up around money. That’s not fair, but it’s also not an excuse.

The wealthy aren’t smarter than you. They just know things you haven’t learned yet and have habits you haven’t built yet. Everything in this guide is learnable. Everything is actionable.

Your advantage? You’re hungry in a way people who inherited wealth will never understand. You know exactly why financial security matters because you’ve lived without it. That hunger, channeled through smart strategy instead of desperation, is powerful.

Start today. Not tomorrow. Not when conditions are perfect. Today.

Track your numbers. Increase your income. Invest consistently. Avoid stupid mistakes. Build assets, not just income. Stay disciplined for years, not months.

The path from zero to financial independence isn’t easy, but it’s been walked by millions before you. Now it’s your turn.